I’ve taken my time to write this post because I wanted to have a better understanding of using a Discovery Bank account. Switching banks is never an easy decision, and while I’ve not “switched” banks, I am currently running two bank accounts: FNB and Discovery Bank.

I have been testing a Discovery Bank Purple Account since the end of July. It is now three months I’ve been using it and I feel like I understand it slightly better, but over time I will learn more.

Disclaimer: Discovery Bank has waived all fees for my testing duration and of course, the minimum requirements.

I first opened a Discovery Bank account last year to test Apple Pay. So when they made travel announcements in March, I was intrigued and wanted to test it. It was the only bank that was competing with FNB using innovative technologies that suited my interests.

I opened a Discovery Bank acc for R10/pm to test Apple Pay. Smooth process, approved in an hour on a Saturday; generated a virtual card immediately to load onto Apple Pay. I top it up via FNB and use it for small purchases (parking, coffee, etc) so no need to enter a PIN.

— Nafisa Akabor (@nafisa1) June 4, 2021

And another note worth mentioning, I was flooded with DMs when FNB started charging a 2% fee for transactions with global companies (Airbnb, Netflix, Uber, Google, Spotify, Facebook, Bolt, etc.), and recently a friend showed me their transactions while abroad and was horrified at the 2% charge per swipe. Discovery Bank does not charge a transaction fee for global companies, and when I swiped my card in Rwanda, it didn’t carry additional fees like FNB.

I’m sharing my experience from the last 3 months to give you an idea of how the banks differ, and for those who reached out about wanting to switch due to the above mentioned charges.

Card Collection

I fetched my card from the Sandton office and didn’t understand why they wanted to hand it to me in person. It was because of the whole experience that is a Purple Account, and of course, packaging. It comes inside a box with the two cards (debit and credit), two luggage tags with a holder, and mini insert about the product. Officially on the Discovery Bank website, the purple account is called an Infinite Account. There’s also a Gold, Platinum and Signature (Black) account.

Understanding the app

The Discovery Bank app uses the same credentials as your Discovery medical aid account. When I first created a bank account, I didn’t use the credentials created over 15 years ago (because of a silly username), and started afresh with a separate email address. This caused confusion later on when my accounts were merged and I could only use the original credentials attached to the medical aid. If you open a Discovery account and have medical aid with them, use those credentials to avoid issues later on.

Initially the unfamiliar interface felt overwhelming. I dedicated time to playing around so I could understand how to quickly navigate. At the bottom you can access Home, Accounts, Transact, Cards and More.

The home tab on the Discovery app will provide a snapshot of everything you have under a Discovery portfolio. This includes your bank portfolio; Vitality Money status (5 sections in rings with status); Financial Advisor Graph (lists average spend, expenses, remaining); Rewards (dynamic interest rates uniquely tied to your financial behaviour); Discovery Miles balance; discounts across the board (life, exercise to miles, Woolies/PnP, Dischem/Clicks, international flights, local flights, Uber and fuel).

In terms of navigating, the rest are self-explanatory, with regards to going into your accounts (more below), transacting (pay, transfers, purchase, lounge), cards – here you can view all cards, create virtual ones and add it to Apple Pay, and More for everything else.

Accessing your accounts

The accounts tab on the top give you a snapshot of your status of everything, and further below you can see every account attached to your ID. This includes the debit and credit card facility, any forex accounts, Discovery Miles, Vitality Savings Account, Easy Equities portfolio for shares, Invest Portfolio, and Health Portfolio (medical aid). I like that this tab shows your medical aid.

Inside your main banking accounts you can see a list of all transactions. Red is money going out, and black is money coming in, visually it’s brilliant. It has a “smart search” to access money in, money out and by transaction: debit orders, fees, interest, payments, purchases, transfers, withdrawals, rewards. Additional parameters include dates, amounts, and text. I love that you don’t have to scroll endlessly.

The transact button will let you pay others by adding them as beneficiaries, do transfers between your accounts, purchase prepaid water, electricity, airtime, data, etc; and generate QR Codes for lounge access.

Fee structure

The Purple account is the highest tier, and for comparison, I will refer to an FNB Private Wealth Fusion account that I’m on. I’m paying 50% fees because it’s a spouse account but my accounts are all separate.

NB: I am using rates from the comparison tool on the Discovery website, which can be accessed here: https://www.discovery.co.za/portal/bank/product-comparison-tool – it works with banks like Absa, Capital, FNB, Invested, Nedbank, RMB, Standard Bank and TymeBank.

The fees are more on Discovery Bank at a quick glance, but you earn interest based on your account balance, tied to Vitality Money and they are dynamic. More on Vitality Money further below.

| Discovery Bank Purple | FNB Private Wealth Fusion | |

| Monthly fees (excl transaction fees) | R570 + R2950 annual card fee | R525 |

| Monthly bank access fee | R445 | R525 |

| Overdraft and credit card fee | Single credit facility R60 | included |

| Bank Reward access fee | R65 | included |

| Withdrawal fees | n/a | free |

| Withdrawal at other local ATMs | free | free |

| Debit orders, EFTs, withdrawal at retailers, and international ATMs | free | free |

| Real-time payment clearance | free | R60 (Discovery tool says it’s free, I can confirm it is not) |

| Cash deposit | R19.95 per R5 000 at Pick n Pay stores, R19.95 per R3 000 at Checkers stores | R20 000 free at FNB ATMs per month, R1.30 per R100 afterwards |

| Interest earned on cheque/current account | 3% – 4.5% based on Vitality Money status, with any balance | 0% |

| Interest earned on credit card account | 3% – 4.5% based on Vitality Money status, with any balance | Up to 0.5% |

| General spend rewards | Up to 1 Discovery Mile per R15 spent (Up to 0.67% back) |

Up to 4% back |

Rewards

When it comes to Rewards, this is something each individual has to work towards. FNB changes the goal posts every year making it more difficult, and with Discovery, the max discount of 75% is tied to working towards Vitality Health and Vitality Money.

The quick takeaway here is that Discovery will reward you for being fit and active on the one hand, and then being good with your finances.

| Discovery Bank Purple | FNB Private Wealth Fusion | |

| Groceries | Up to 75% back on HealthyFood items (Woolworths or PnP) | Up to 15% back (Checkers and Shoprite) |

| Personal care rewards | Up to 50% back on HealthyCare and HealthyBaby items (Dischem or Clicks, BabyCity) | Up to 15% back Clicks |

| Fuel | Up to 20% back (Shell, BP) |

Up to R4 back per litre (Up to ±17.1% back) Engen |

| Uber | Up to 20% back | n/a |

| Apple | Save up to 100% on a new Apple Watch and get cash back on a new iPhone | Up to 15% back iStore |

| Fitness devices | n/a | Up to 75% off fitness devices and Nike performance gear (Sportsmans Warehouse, Total Sports, Nike) |

| Local flights | Up to 75% off six one-way flights Unlimited 10% off afterwards |

Up to 40% off Eight return flights |

| International flights | Up to 75% off two bookings, with the option of one in business class Unlimited 10% off afterwards |

Up to 40% off Two return bookings |

| Accommodation and car hire | 10% to 25% off | Up to 40% off Avis |

| Airport lounge visits | Up to 36 domestic visits and up to 12 international visits a year to The Lounge in South Africa, plus unlimited visits a year to over 1 200 lounges worldwide with LoungeKey Priority Fast Track at OR Tambo and Cape Town International Airports |

Up to 60 visits per year in South Africa, plus 10 visits worldwide SLOW Lounges, Bidvest Premier Lounges, and LoungeKey |

| General spend | Up to 1 Discovery Mile per R15 spent (Up to 0.67% back) |

Up to 4% back |

You can also read more about the Vitality Travel opening up to all Discovery clients:

Vitality Money

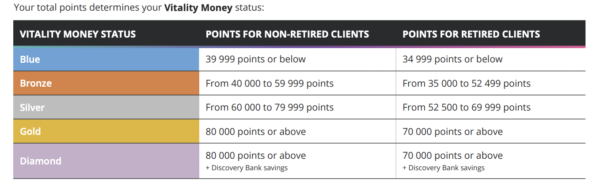

Vitality Money is a rewards programme for Discovery Bank the same way eBucks is for FNB. It works on a gamification aspect, like with Vitality Health, so if you ‘bank healthier, you enjoy better interest rates on savings and lower interest on credit’. If you’re good with your money, you get rewarded. The tiers are blue, bronze, silver, gold and diamond.

There are five behaviours that earn you points: savings, debt, insurance, retirement, and property. At a quick glance, you can tell that if you own property, have insurance (short term, life, medical), and retirement funding, you will get the points to get onto a higher tier. Then the other two are based on your savings and how much debt you’re in (please also understand this is my 3 month takeaway from the programme).

One of the biggest differences I noticed with Discovery Bank is that I earn the maximum 25 000 points for the Debt ring because my “debt repayments are less than the minimum threshold”. I typically use credit cards after I save my money for something, so I load it on there and swipe. I rarely rack up debt that goes over the 55 day interest-free period. FNB has never rewarded me for having a credit card that was mostly paid up.

I bought a lot of forex for a trip (but Rwanda made it difficult because lack of digital payment options), and my status moved to Silver from Bronze. Which means, even if I don’t buy forex, but put money into Vitality Savings, I will climb the ranks. And the biggest difference between Gold and Platinum is the amount of savings you have, which means over time, you can close that gap.

The visual rings most definitely help, and if you’re a competitive person, you’ll want to try and do everything to close those rings and earn as much points as you can. There’s whole PDF document for understanding Vitality Money, which you can read here.

If you have both Vitality Health and Vitality Money, you can join Vitality Active Rewards to earn Discovery Miles weekly, like a bonus. It incorporates health, drive and money goals. Depending on how well you do, you earn plays on the gameboard that unlocks Miles. It’s just another way to motivate you. I personally will not take out car insurance with Discovery and have my driving behaviour analysed. I will probably get penalised every week, haha!

There’s also motivation to buy healthy food from either Woolworths or PnP, I chose Woolworths and if you buy the Vitality items you earn Miles back. The same applies for other partners across the board, Clicks or Dischem, Shell or BP, and airlines and travel benefits.

Climbing the ranks

In the time I’ve been using the Discovery Bank Purple account, I’ve made effort to make it work, and again, I’m going to stress, I’ve been using it for 3 months only but it’s not as convoluted as eBucks. I could have pushed harder but I have so much going on. I will take my time.

Since I don’t get into debt, I know I will always earn that max 25 000 points. And I have 2/3 things on the insurance aspect, so I’m earning 75% of those points. I started a new retirement funding with Discovery to boost that, and I’m working towards the others. I still have money on FNB and my tax-free savings are with them, including shares. I’m taking my time to understand it still, I’m no expert, but I like that I’m being rewarded for making good financial decisions.

What I’ve come to understand about Discovery, it’s all about being fit, healthy and making sound financial decisions, in order to leverage the benefits of both Vitality Health and Vitality Money. If you don’t have a fitness tracker, and not interested in working out, this bank probably isn’t for you, because to make it work, you have to get into this. And it’s totally okay if this isn’t your personal goal.

I like the gamification aspect because I’m a competitive person. It will keep you motivated, above everything else. I mean last week in my hotel room for an event that I was with a friend, I was literally walking up and down for a few minutes till I hit 10 000 steps. Yes, it sounds crazy, but it was worth it to me. The older I get, the more I want to focus on my health and if this isn’t giving me motivation, then what will?

A family member also saw what I was doing, signed up for a bank account and managed to get to Bronze that same weekend (helps owning a few properties) and if you think I’m competitive, you haven’t met him. He got ahead of me in a shorter time, but it’s okay, I’m happy with my pace.

This is just to illustrate that they are 5 behaviour patterns you can work towards to earn points and get the rewards. It is currently not as difficult to climb the ranks as eBucks, but this is a new bank, and I don’t know in future if the goal posts will also be shifted. For now, it is working for me.

Lifestyle Benefits

As a frequent traveller, and also why I was excited to test this account is the fast track queue at airport security in SA, which helped me numerous times due to work trips over the last few months. Load shedding traffic is a nightmare, and it makes a difference knowing you don’t have to race to get through airport security once you get there. And another cool feature is the fast track when you land back in SA.

I also opened a real-time forex account so I can buy forex instantly. A few months ago it came in handy when I was serious about buying and used the real-time rate (refreshes every 60 seconds). But I want to point out a current disadvantage here is that once you buy the forex, in my case, US dollars, you can’t get it as cash before leaving SA. It is all digital. You can tap, swipe, insert to pay for goods in $ out of SA, but also make sure the country you’re going to lets you withdraw in that currency – Rwanda did not have ATMs that dispense US$.

And another thing I have to be honest about right now, the Lounge by SAA and Discovery is currently no match to the Slow Lounge. I have used both and the Slow Lounge is still the clear winner here. I understand the Lounge is being upgraded, so let’s see how that changes. What I love about these lounge accesses by the banks is that you can generate a entry code directly from your app. So you don’t physically have to show a card anymore, if you travel light or use virtual cards.

One last thing…

I know this is already a lengthy post but I still want to emphasise a few things. At three months into my testing, this is still a short time to understand a new digital bank and its reward aspects, but I know a little to know that I like what I see. This took a long time to put down, so if I made any errors with amounts, please accept my apology for any oversight.

When it comes to making financial decisions, please speak to a broker or consultant at the bank to help answer your questions if you want to switch. Yes, this is a purple account but the Vitality Money works on all levels as you saw on the screenshot. It is not difficult imo to work towards the levels you can get good discounts for, assuming this is what you want from a bank.

I’ve also been working towards getting more points on Vitality but trying to maintain my FNB rewards level and while it’s not as easy, it’s doable but I do see the benefit of having two bank accounts, if you factor fraud – smartphones being stolen and accounts cleared, and keeping savings and transactional separate.

Disclaimer (again): Discovery Bank has waived all fees for my testing duration and of course, the minimum requirements.

Nafisa Akabor

Related posts

ABOUT

Recharged is an independent site that focuses on technology, electric vehicles, and the digital life by Nafisa Akabor. Drawing from her 16-year tech journalism career, expect news, reviews, how-tos, comparisons, and practical uses of tech that are easy to digest. info@recharged.co.za